edit: I shouldn’t have blasted this AVDG company…I support small businesses, and don’t wish to trash anyone’s business that hasn’t done me any harm. My apologies.

First of all, I think this merger is a pretty small time deal. this is nowhere nears as big of a deal as it looks.

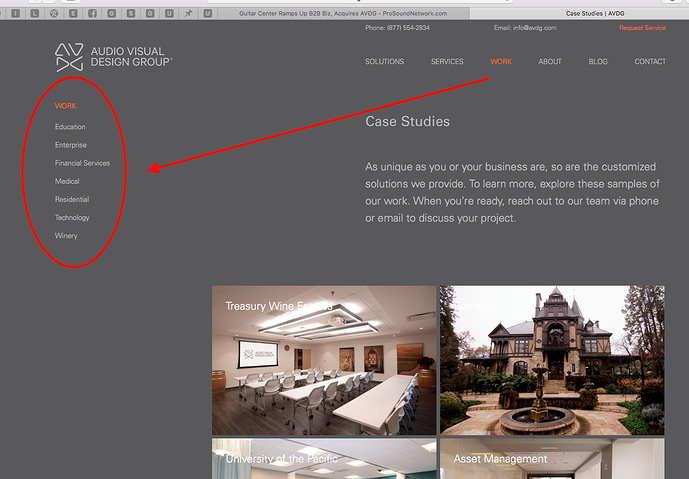

At first I was excited to hear about the merger, but then I took a look at the AVDG website…and…they seem to be quite good at um…hanging TV’s on the wall??

Ok. Now that you see what this company really is…who is anybody fooling?

I get that you need nice pictures to make a website look sophisticated. I congratulate this company for employing 80 people.

…But when I look at industries for which they hang TV’s on the wall, I’m surprised GC found this to be a fit.

I don’t get how either side benefits from this deal? This company needed to get bought by B&H or Mono Price or Bestbuy. What is GC gonna start selling TV screens? And home stereo equipment??? What the HELL were those ass clowns at GC thinking? It almost makes you laugh!

“Guitar Center has been seeking opportunities to bolster our Business Solutions Group and we have found an ideal partner in AVDG. This mutually beneficial relationship will provide AVDG’s team the vast resources offered by Guitar Center, while opening up Guitar Center’s Business Solutions Group to opportunities in the commercial and residential market sectors.”

I’m so pissed at GC for the last 10 things I bought there and had to return that I’m just done with it.

This one really gets me…from their CEO.

“There’s still a reason to have stores,” Majeski said. “If you’re going to buy a $1,500 guitar, you’re not going to do it on Amazon.”

Think about what that’s really saying. Is this guy clueless as to how competitive online retail is?? Now he may be right that most people want to play a guitar in person. But a $1500 interface? A $1500 midi controller? A $1500 hardware compressor? A $1500 copy of Nuendo? Those things are not like guitars. They’re all identical. You’re damn straight we’re ordering it online!

Oh no no no. Just so you know, the Ares acquisition was in 2014. Well after the recession. And junk bonds mean high risk high yield. Not ‘unable to pay back’. Bain leveraged to acquire GC. (That means it borrowed to invest). Ares re-infused cash into GC paying down its debt in exchange for equity. I think all of this was good. For both groups.

But ultimately Bain and its shareholders allowed this company to be run into the ground. I don’t believe it was deliberately negligent or overly insensitive to customers. It was just a company it failed to save from itself.